|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Best HELOC Options in Texas: What You Need to KnowWhen considering a Home Equity Line of Credit (HELOC) in Texas, it's crucial to understand your options and choose the best one for your financial situation. A HELOC allows homeowners to borrow against the equity in their home, providing flexibility and potentially lower interest rates. Understanding HELOCs in TexasHELOCs are popular due to their revolving credit nature, enabling borrowers to withdraw funds as needed. In Texas, certain regulations impact how these loans operate, offering both benefits and restrictions. Key Features of a Texas HELOC

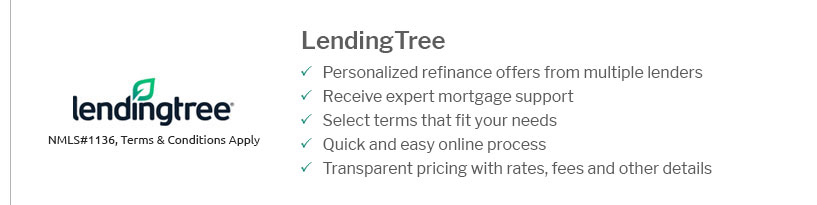

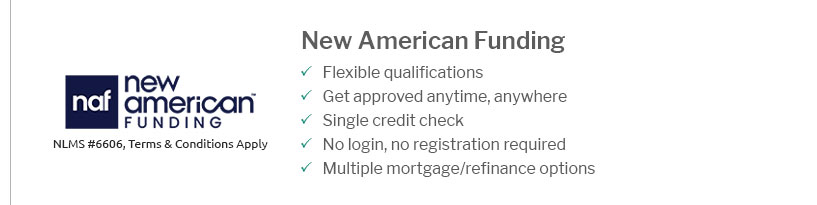

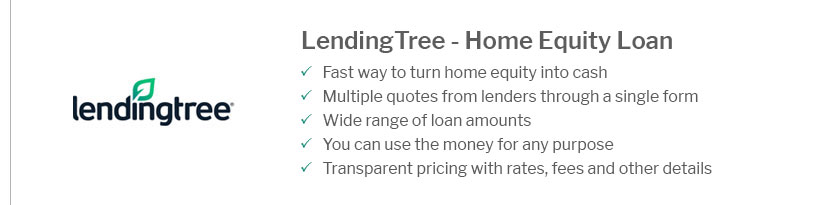

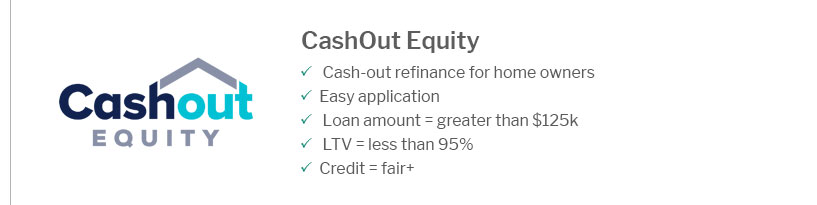

Choosing the Right LenderWhen selecting a lender for a HELOC in Texas, consider factors such as interest rates, fees, and customer service. Comparing lenders can significantly impact the cost-effectiveness of your loan. For a better understanding of refinancing options, the streamline refinance calculator can be a helpful tool. Top Lenders in Texas

Applying for a HELOCThe application process involves several steps, including a credit check, home appraisal, and income verification. Understanding each step can help ensure a smooth application experience. Tips for a Successful Application

For those exploring other financing methods, an online housing loan might also be worth considering. FAQWhat are the typical fees associated with a HELOC in Texas?Typical fees may include application fees, annual fees, and appraisal costs. It's important to ask each lender about their specific fee structures. Can I use a HELOC for any type of expense?Yes, HELOCs can be used for a variety of expenses, such as home improvements, education costs, or consolidating debt. However, using the funds wisely is crucial to avoid over-leveraging your home. Is a HELOC tax-deductible?Interest on a HELOC may be tax-deductible if the funds are used to buy, build, or substantially improve the home securing the loan. Consulting with a tax professional is recommended to understand your specific situation. In conclusion, finding the best HELOC in Texas involves careful consideration of your financial needs, understanding state-specific regulations, and comparing lender offerings. By taking these steps, homeowners can effectively leverage their home's equity to meet their financial goals. https://www.reddit.com/r/RealEstate/comments/19a6ge6/are_helocs_just_not_a_thing_in_texas/

The hard part with TX HELOCs is finding a lender that can do them. Your normal mortgage lenders will have limited options and your best bet for ... https://www.reddit.com/r/Mortgages/comments/1ck7alq/home_equity_loan_tx/

A local bank or credit union would likely be best, good luck! ... Texas has very strict cash out and Heloc restrictions. Most lenders ... https://www.discover.com/home-loans/articles/home-equity-loans-texas/

Lock in the best home equity loan interest rates in Texas - Check your credit score: - Check your credit report: - Keep your debt-to-income (DTI) ...

|

|---|